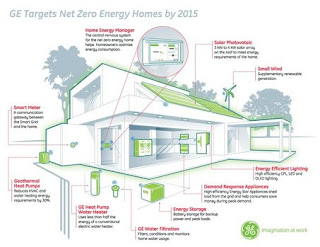

In an effort to serve growing demand for a broad spectrum of energy efficiency improvements that can be made to our homes, GE recently announced plans to become a one-stop shop for residential energy efficiency products (Source: EnergyEfficiencyNews.com, July 15). In addition to some of the more conventional products that GE offers, such as energy efficient light bulbs, appliances, and climate control consoles, the company will soon add residential energy generation and storage products. GE estimates that by improving the energy use of appliances, HVAC systems, and lighting, peak energy demand will decline by 7% in the United States.

In an effort to serve growing demand for a broad spectrum of energy efficiency improvements that can be made to our homes, GE recently announced plans to become a one-stop shop for residential energy efficiency products (Source: EnergyEfficiencyNews.com, July 15). In addition to some of the more conventional products that GE offers, such as energy efficient light bulbs, appliances, and climate control consoles, the company will soon add residential energy generation and storage products. GE estimates that by improving the energy use of appliances, HVAC systems, and lighting, peak energy demand will decline by 7% in the United States.As we look at the expansion of energy offerings that could feasibly enter the residential market in the coming months and years, one wonders which methods will truly be the most cost effective in the long run. Though most people are aware by now that better insulation, smart climate control consoles, energy efficient light bulbs and other small items can drastically reduce energy waste in their homes, what can be said of energy generation products designed for residential use?

For most, residential solar panels, wind turbines and other energy generation technologies have historically been out of reach both financially and logistically. As I mentioned in this earlier blog, however, the options available to the average homeowner in terms of renewable energy hardware and financing for such systems are increasing rapidly. The price of solar panels, for example, has dropped 40% this past year, opening the door for some to consider installation of such panels on their property for the first time (Source, NewYorkTimes.com, August 28).

For most, residential solar panels, wind turbines and other energy generation technologies have historically been out of reach both financially and logistically. As I mentioned in this earlier blog, however, the options available to the average homeowner in terms of renewable energy hardware and financing for such systems are increasing rapidly. The price of solar panels, for example, has dropped 40% this past year, opening the door for some to consider installation of such panels on their property for the first time (Source, NewYorkTimes.com, August 28).In addition to improvements in technology and the reduction in price of some renewable energy components, government and utility subsidy programs for residential renewable energy systems are also starting to gain momentum. Though a reduction in market pricing and increases in availability of private financing for such systems is a positive trend, the impact of government subsidization and financing programs face a high standard of scrutiny. With a wider range of options now available for both energy conservation and renewable energy generation in the typical residence, a recent article in the Wall Street Journal raises an important question where our tax dollars are concerned; “…should the government be doing more to subsidize conservation?”

This same article cites a study by a consulting firm McKinsey & Co. that examined the cost of eliminating one ton of CO2 emissions via different methods, including light-emitting diodes, energy efficient appliances, wind power and solar power (Source, Online.WSJ.com, July 15). The study found, not surprisingly, that reducing energy demand through an upgrade of more efficient items for the home reduced CO2 more cheaply than generating new energy through the installation of renewable energy collection devices. The latter part of this article goes on to discuss a bill that’s pending in congress right now that would do just such a thing by offering tax incentives for homeowners and businesses who install these energy saving items. In addition to its focus on reducing energy demand, the bill is structured on a results-basis so as to provide the greatest incentive for the most energy demand reduced.

Government Funding - Upgrades for the Home

Many countries worldwide are rolling out with similar energy efficiency incentive packages, such as a £15 million home makeover package, which will provide free energy audits, advice, and free or discounted insulation materials to 96,000 homes (Source: EnergyEfficiencyNews.com, August 3). As I mentioned in an earlier blog, there are similar programs being considered or implemented at national, state and local levels, such as Boulder County's (Colorado) ClimateSmart program, which loans income-qualified homeowners up to $50,000 to make energy efficiency improvements to their homes and applies the debt to the property itself. ClimateSmart participants may also install renewable energy hardware under the program, including photovoltaic, solar thermal, or wind energy systems (a full list of approved projects is available at this link).

Many countries worldwide are rolling out with similar energy efficiency incentive packages, such as a £15 million home makeover package, which will provide free energy audits, advice, and free or discounted insulation materials to 96,000 homes (Source: EnergyEfficiencyNews.com, August 3). As I mentioned in an earlier blog, there are similar programs being considered or implemented at national, state and local levels, such as Boulder County's (Colorado) ClimateSmart program, which loans income-qualified homeowners up to $50,000 to make energy efficiency improvements to their homes and applies the debt to the property itself. ClimateSmart participants may also install renewable energy hardware under the program, including photovoltaic, solar thermal, or wind energy systems (a full list of approved projects is available at this link). On a national level and as a part of the American Recovery and Reinvestment Act, tax credits are available at 30% of the cost, up to $1,500, in 2009 & 2010 for several energy efficiency improvements to existing homes, including roofs, HVAC upgrades, insulation, water heaters and more (Source: EnergyStar.gov). On the renewable energy side, the Federal Government is offering a 30% individual tax credit for residential solar electric expenditures through December 31, 2016, several of which have no upper limit on the base cost (Source: Energy.gov, EnergyStar.gov). This renewable energy tax credit includes small wind property credits with a cap of $4,000 and geothermal heat pumps up to $2,000.

On a national level and as a part of the American Recovery and Reinvestment Act, tax credits are available at 30% of the cost, up to $1,500, in 2009 & 2010 for several energy efficiency improvements to existing homes, including roofs, HVAC upgrades, insulation, water heaters and more (Source: EnergyStar.gov). On the renewable energy side, the Federal Government is offering a 30% individual tax credit for residential solar electric expenditures through December 31, 2016, several of which have no upper limit on the base cost (Source: Energy.gov, EnergyStar.gov). This renewable energy tax credit includes small wind property credits with a cap of $4,000 and geothermal heat pumps up to $2,000.Return on Investment - Thoughts on Spending Stimulus Dollars Wisely

As efforts to reduce CO2 emissions ramp up in the United States and worldwide, it will be interesting to see how many new programs will be geared toward simple efficiency upgrades as opposed to renewable energy research and industry. Currently, there's a wide variety of funding and programs in place at the federal, state, county and some city levels for either or both types of improvements. While the goal is to ultimately reduce our overall pollutant waste, we should also be mindful of squeezing the most energy savings out of each dollar we spend wherever possible. I expect to see a rash of cost-effective net energy-savings studies on both commercial and residential properties in the coming months as individuals and builders begin utilizing stimulus funding to pursue these upgrades. My hope is that these studies will also factor in the net employment stimulus effect that these projects are having so that funding is most strongly allocated to those that are serving the dual purpose of employing the most workers for the most energy savings gained per dollar spent.